TDF – Where to start from?

Visitors of this blog have asked more information about TDF and instead trying to explain it with my own words I talked to my friend and TDF guru Karen Rodrigues who was so kind to allow me to translate her entire post from SCN.

Yep! I know what you are thinking… she is great… So, please, if you found this information useful, take half of a minute to rate her post on SCN with 5 stars: TDF – Por onde começar?

First things first: What is SAP TDF?

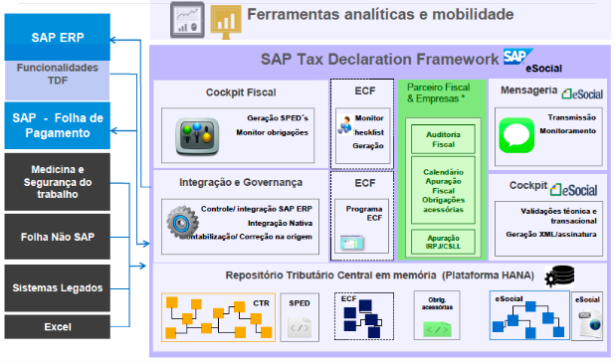

The Tax Declaration Framework (TDF) is a new SAP Fiscal/Tax Management platform, that enables increase the quality of information generated, as well to increase Tax and Financial department productivity, allowing companies in Brasil to meet the legal requirements related to reports such as Accounting SPEC (ECD), Fiscal SPED (EFD ICMS/IPI), E-SOCIAL, ECF, SPED Contributions (PIS/COFINS) and etc.

Powered by HANA

The TDF runs over the in-memory SAP HANA database to consolidate fiscal and tax data with a complete governance and integrated with ERP Systems, that means, it is not required an interface to extract data or complex data migration. With TDF, the data are synchronized automatically with SAP and non-SAP system, and remodeled to memory through the views. Among of the advantages, you will find the fast data processing, the predictive analysis, analytical dashboard, mobile device integration and other features.

How is the day-by-day of Fiscal Tax Department?

Each month, the tax and fiscal department has a massive volume of data and information that needs to be reports only few days after monthly closing. Due to that, there is a huge usage of resources to analyze and maintain the data in preparation to submit the legal reports.

To perform the closing, the companies usually make usage of add-on or bolt-on software provided by SAP Partners, where majority of the data are generated on SAP and extracted to the partner tool. Here is the first disadvantage: the data extraction is not standardized and it is not real time, allowing data discrepancy. This compromise the visibility and transparency of the process due to the short deadline to the fiscal and tax department to plan and take an action on the issues found.

How does the TDF can help?

It work integrated with SAP ERP, SAP Payroll, HCM, EH&S, non-SAP Payroll, other legacy systems, MS Excel and etc.

Advantages

- Digital File generated in accordance to the Tax Authorities

- Reduces the risk and improve the data accuracy

- Real time data analysis

- Architecture complexity reduction

- Tax Credit/Recoverable otimization

- Fiscal Tax Department performance increased

- Reduction of fines for issues on tax reports

Check the latest updates released via TDF SP:

Scope:

Central Tax Repository

The HANA CTR gets data from different sources and consolidates it in one single layout model based on SPED official Layouts. Both the TDF and the 3rd partner solution makes usage of the CTR for different purposes such as: generate the SPED reports, audit the nota fiscals and etc. It doesn’t replicate the data, but only synchronize it via SLT or SAP Data Services.

There are 2 types of data structure to the fiscal documents: Table and Calculation View. Those are subdivided as below:

Tables:

- Standard SAP ERP Tables – The development should not consume the standard tables in their programs, which means, in the front-end.

- CPL Tables – complement tables non-existing on ERP

- Shadow tables – tables that are used to change data that can’t be changed in ERP and has priority over the data composed from Standard SAP ERP Tables. Besides that, it is possible to add data that it is not available on SAP ERP straight to the shadows tables.

Calculation views:

- Private view – Data is used by CTR only. The Development should not consume the standard tables in their programs, which means, in the front-end.

- Reutilization view – Data can be used by ABAP programs that are possible because HANA Vista is synchronized with Netweaver.

- Report Views – Views for records of ECF, EFD ICMS/IPI, EFD Contributions, ECD…

Persistence of Fiscal Documents

Now it was released a new BAdI to support the data persistence and the maintenance/display of data in the NFe screens as well.

By doing it, it is possible to store the XML data and those will be available both in the CTR and ERP.

The new solution enables:

- New BAdI to allow data persistence: J_1BNF_ADD_DATA

- New fields at NFe Screen for manual input and display

- Better standardized mapping the new fields to the XML.

More information you can find in the link below:

TDF – Persistencia de DF-e

New master data fields

It was created new fields on ERP to master data: customers, vendors, materials, and business place. Some of those new fields are now available for dynamic exception (IS-OIL are also supported due to the additions to KOM and KOMP) and the new fields are available to the pricing structure (KOMK and KOMP).

The relevant fields are mapped to the electronic fiscal documents.

Example of customer master data new fields:

- Suframa

- CNAE

- Legal Nature (Natureza Jurídica)

- CRT (cod. Regime Tributário)

- ICMS Tax Payer Type

- Industry Main Type

- Tax Declaration Type

- Company Size

- Declaration Regimen for PIS/COFINS

- RG number, issued by, state, date

- RIC number

- RNE number

More information you can find in the links below (links in Portuguese, but the same content was discussed in this blog: Customers and Vendors – New fields NFe 3.10)

Dicas sobre novos campos de dados mestre cliente/fornecedor

Online Validation

Online Validation auditing at the execution time via existing rules evaluating the quality of information.

To guarantee the transactional data integrity of data created by the users during their daily job, it was added verification rules engine BRF+ at several processes, such as:

- Master Data maintenance

- Sales Order

- Remittance

- Invoice

- Purchase Order

- Materials Movement

- Invoice Verification

- Nota Fiscal

More information you can find in the links below (in Portuguese, to be translated in this blog soon, meanwhile, please, visit the link and rate it 5 stars please)

TDF – Validação Online – Ex. Mestre de Materiais

Tax Obligation Monitor

You use the Tax Obligation Monitor to keep track of all legal obligations that have electronic deliverables, such as SPED ECD and SPED EFD.

The concept of official-execution of fiscal obligation/ tax reports brings to the integration with the Fiscal Obligations monitor. Once it is set for official execution, some validations will occur as: if the fiscal period is in the status report, as well if already exists another official execution in process with the same key.

This service will control the status of each fiscal obligation and tax report to be generated via TDF and by the interface application (3rd partner). Besides that the files can be maintained safely in the database.

The Fiscal Obligation Monitor will be used for:

-

The report shows details of the following files:

-

Application file – Tax obligation output created by the application without any manual changes

-

Submitted file – File that was edited, signed and finally sent to authorities. It is sometimes necessary to edit an application file to make changes before finally submitting the file to the authorities.

-

Proof of Delivery – File which contains the proof of delivery, for example, a receipt protocol file or any other equivalent proof of delivery.

-

Auxiliary file – File used during processing of a submitted file. There can be multiple files, for example, auxiliary documents used for the declaration calculation, supporting emails for manual changes in the system-created file, or manually edited versions of the final obligation.

-

More information on executing the SPED report via TDF you can find in the links below (in Portuguese, to be translated in this blog soon, meanwhile, please, visit the link and rate it 5 stars please):

Execução de relatórios SPED com TDF SP05

Enhancements on SAP ERP

MM VAT Determination

- NAVS Condition Type (MM)

- DSM (Decision Service Management) Optional (BRF+)

- Additions done via TDF for tax code determination in Brasil

SD VAT Determination

- Additions done via TDF for SD tax code determination in Brasil

- New fields at the “Country” view

- BAdI automated for re-assignment and to define the reassignment

- DSM (BRF+)

More information on the ERP Enhancements you can find in the links below (in Portuguese, to be translated in this blog soon, meanwhile, please, visit the link and rate it 5 stars please):

Implementando TDF – Condição NAVS x BRF+

Implementando TDF – Determinar Tax Code no Pedido de Compra – Tipo de condição NAVS

Implementando TDF – Determinar Tax Code no Pedido de Compra usando o BRF+ – PARTE 1

Implementando TDF – Determinar Tax Code no Pedido de Compra usando o BRF+ – PARTE 2

SAP Tax Declaration Framework – Melhorias em SD

Writer Nota Fiscal Accounting Posting

Some processes in Brasil requires that the Nota Fiscal is created with accounting posting, but there is no process automated in MM, SD or FI transactions, for example:

- ICMS Tax Credit Transference

- Complement Tax Nota Fiscal

- Miscellaneous remittance or returns of material without stock control or master data

To those scenarios, the TDF offers the possibility of issuing the Writer Nota Fiscal with automation to the accounting posting

More information on NF Writer Accounting Posting you can find in the links below (in Portuguese, to be translated in this blog soon, meanwhile, please, visit the link and rate it 5 stars please):

TDF – Contabilização automática de NF writer em 10 min!

Inventory Adjustment

In Brasil, the stock adjustment process might require that a nota fiscal is issued and taxes are calculated. That varies according to each UF legal requirements and each company’s legal understanding. The rules been flexible, the TDF brought a flexible and simple solution for that.

CIAP

The CIAP (Credito de ICMS do Ativo Permanente, or ICMS Credit over Fixed asset) is part of the SAP TDF solution. The proposal is to make usage of SAP HANA in the execution of the legal tax reports that are issued to the government periodically. The CIAP data feeds several views that will be used mainly to report the information of SPED EFD Fiscal Block G.

SPED Legal Tax Reports Submit

HANA Native support to report the legal tax obligation and reports: ECD, EFD ICMS/IPI, EFD Contributions, ECF, e-SOCIAL.

More information on executing the SPED report via TDF you can find in the links below (in Portuguese, to be translated in this blog soon, meanwhile, please, visit the link and rate it 5 stars please):

TDF – Escrituração Contabil Fiscal (ECF)

TDF – Passo-a-passo para gerar o ECF

Passo-a-passo para execução do SPED EFD ICMS/IPI no TDF

TDF – Passo-a-passo para execução do SPED EFD-Contribuições

Want to know more? Check the links below:

VIDEO:

HANA Academy – Replicando dados do sistema SAP em SAP HANA com SLT

TDF – Vídeo sobre Estrutura Organizacional

TDF – Vídeo: Apresentação de uma ficha de CIAP

SCN Blog Posts: SAP HANA (Portuguese)

Implementando SAP TDF – Replicando os dados com SLT

SLT e TDF – Ponto ideal de colocar os filtros

Explorando views TDF com o SAP HANA Live Browser

TDF – Conhecendo e entendendo o OrgStr

SAP HELP:

SAP Tax Declaration Framework for Brazil – SAP Help Portal Page

Cheers Karen Rodrigues

Karen’s LinkedIn: https://br.linkedin.com/in/karenrodrigueskrp

SAP LABS LATIN AMERICA