Stock Transfer Order (also known as STO or Transport Order) are used to transfer products from one plant to another plant. This guide will cover the STO Intracompany (when the 2 plants belongs to the same company code). In Brasil, a nota fiscal and taxes calculation are not only required when goods are sold to customers (and other goods movements) but also when products are transferred between plants. To be able to generate a STO using MRP, the goods issue is done via SD Delivery Note and the goods receipt is processed via MM goods receipt functionality, and with all settings in place, it will cover the requirements of Nota Fiscal Outgoing and Nota Fiscal Incoming with taxes calculation and etc.

This guide is a “guidance” but depending on your business requirements and the way how the process will be handled, it may change slightly. I am assuming you have some SAP experience when reading this guide, that is, you may disagree of one or other configuration in here, that’s ok! There is not only one way to some of those configurations.

Companies and Consultants may diverge on the responsibilities on this process. Is that MM? Is that SD? The answer is that it is Cross-Function; It is a split responsibility between MM and SD (Logistics), however, it is common that an expert MM can do all the settings or a strong SD can do all by himself.

The posting steps are as follows:

- Create a stock transfer order (UB or equivalent) in the receiving plant within MM using Transaction ME27 or ME21N and Item type ‘U’

- Generate delivery document within SD using transaction VL10B

- Picking and posting goods issue in SD using transaction VL02N

- Output (submit for approval) the Electronic Nota Fiscal (J1BNFE)

- Posting goods receipt in MM using transaction MB0A or MIGO and movement type 861

- The STO document Type is defined in Customizing. The assignment between Supplying Plant and Receiving Plant will define the correct STO Document Type;

- The delivery type is defined via customizing, maintained via assignment between STO Type and Supplying Plant;

- During creation of the Delivery Document, the item category is defined based on delivery type and item category group (based on material);

- Based on the Delivery Document, the PGI will trigger the Stock movements using Mvt. Type 862 which is Nota Fiscal Relevant.

- The NF-type is determined via the Delivery Item Category. A sales order item category is linked to this delivery item category. Via Customizing a NF-type is linked to this sales order type, sales order item category;

Receiving Plant must post GR in reference to the Nf-e created by Supplying Plant using the Mvt. Type 861

ACCOUNTING

Accounting at the Plant-to-Plant – Brazil – Intracompany Stock Transfer Order. I added the Plant numbers and G/L Account numbers in my example below to help understanding.

1) Goods Issue at issuing Plant (1440)

- Debit – Stock at Receiving Plant (5611)

- Credit – Stock at issuing Plant (1440)

- Credit – ICMS Due (recolher) at Issuing Plant (1440) 21305401

- Debit – Tax Transitory (TXO) 11513410

2) Goods Receipt at the Receiving Plant (5611)

- Debit – ICMS Credit (recover) at receiving Plant (5611) 11513410

- Credit – Tax Transitory (TXO) 11513410

Goods Issue from 1440 to 5611

Goods Receipt from 5611 to 1440

The configuration and processing steps in this post may vary slightly depending on your own requirements. But I believe that this guide will help you troubleshooting or implementing the STO intracompany process in Brazil.

MOVEMENT TYPES

You may have noticed by the chart above that there are four new movement types used to post a stock transfer order:

- Movement type 861 for Goods Receipt

- Movement type 862 for Goods Issue

- Movement type 863 for Return of Goods Receipt

- Movement type 864 for Return of Goods Issue

Those movement types are required as Taxes needs to be calculated through goods movement and nota fiscal needs to be triggered by those movements.

If you don’t have those movements in your system, you may want to look the OSS Note 323649 – BR/TF: Creation movement types for Stock Transfer

After getting the movements created, you will also need to adjust table T156SC;

Check OSS Note 805584 – M7226 error with movement 645 for a non valuated material

The OSS Note explains an issue with the movement 645 (which is the “corresponding” to 862 in the STO process outside of Brasil environment):

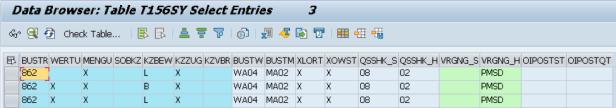

You will also need to maintain the table T156SY

OSS Note 1876282 – Error M7021 in stock transfer return when post goods receipt

And finally you will have to maintain the table V_156X_VC:

EVALUATING MOVEMENT TYPE FOR LIS UPDATE

In transaction SM30, maintain the table TMCA.

Copy all entries for movement type 101 to movement type 861:

Copy all entries for movement type 641 to movement type 862:

Copy all entries for movement type 861 to movement type 863:

Copy all entries for movement type 862 to movement type 864:

Save the changes.

CREATE NEW SALES ORDER TYPE

IMG > Sales and Distribution > Sales > Sales Documents > Sales Document Header > Define Sales Document Type (VOV8)

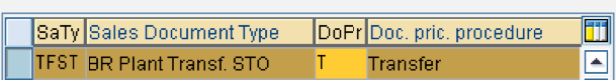

Here you will need to create a new sales order type copying from standard DLB to TFST – BR Plant Transf. STO

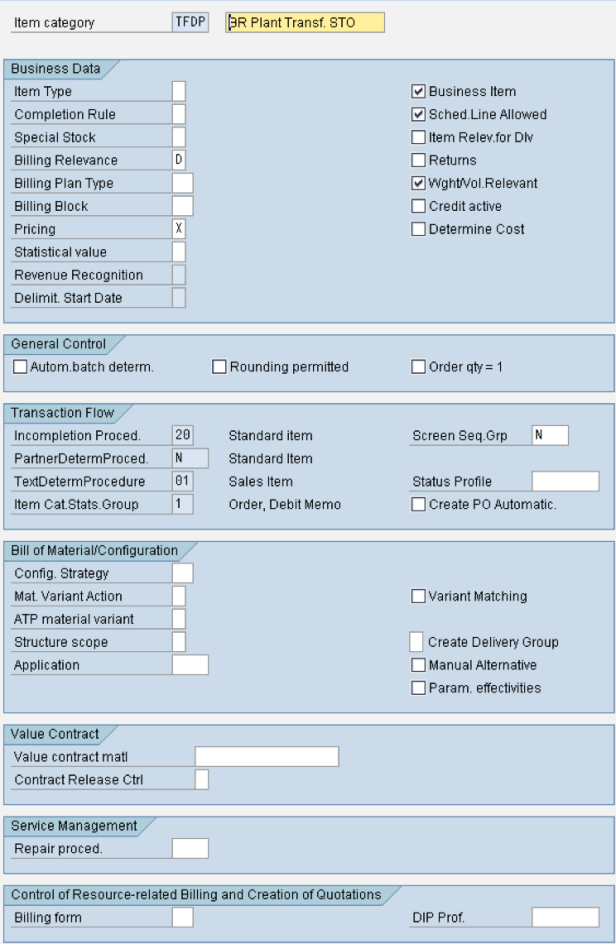

CREATE SALES DOCUMENT ITEM TYPE

IMG > Sales and Distribution > Sales > Sales Documents > Sales Document Item > Define Item Categories

The next step is going to be create a Sales Order Item type; therefore, you will have to copy from NLNB to TFDP – BR Plant Transf. STO

CREATE DELIVERY TYPE

IMG > Logistics Execution > Shipping > Deliveries > Define delivery types (OVLK)

Create a new delivery type copying from NL to TFDT – BR Transf. STO Dlv. and assign default Order Type TFST.

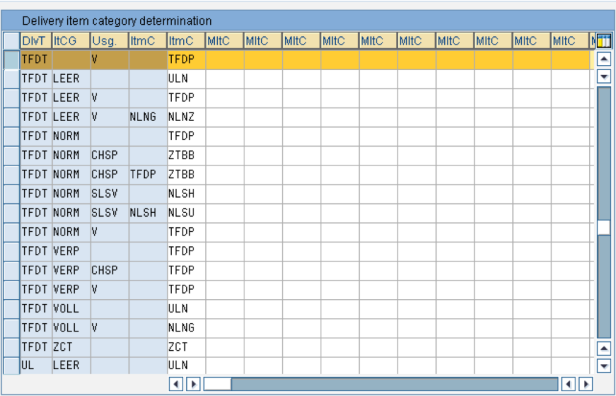

ASSIGN DELIVERY TYPE TO ITEM TYPE

IMG > Logistics Execution > Shipping > Deliveries > Define Item Category Determination in Deliveries

Add a new entry for:

- DlvT=TFDT

- Use=V

- ItmC=”

- ItmC=TFDP

Assignments here needs to be done based on the values you are using to item category, usage and etc., below is one example:

DEFINE SCHEDULE LINES CATEGORIES

IMG > Sales and Distribution > Sales > Sales Documents > Schedule Lines > Define Schedule Line Categories

- Add a new entry: TF

- Item rel.f.dlv = X

- Movement type = Movement type of GI = 862

- Movement type 1-step = Movement type of GI = 862

ASSIGN SCHEDULE LINES CATEGORIES

IMG > Sales and Distribution > Sales > Sales Documents > Schedule Lines > Assign Schedule Line Categories

Add the entry:

- Item category=TFDP

- PropSchdLneCat.= TF

SPECIFY COPY CONTROL FOR DELIVERIES

IMG > Logistics Execution > Shipping > Copying Control > Specify Copy Control for Deliveries

Copy item NL-DL and change NL to TFDT and DL to TFST

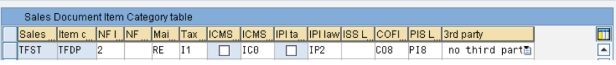

NOTA FISCAL SALES DOCUMENT ITEM CATEGORY

IMG > Sales and Distribution > Billing > Billing Documents > Country-specific Features > Brazil > Maintain Sales Document Item Category

This is the famous (or infamous) J_1BSDICA table, that you can also maintain via SM30;

Here you will add the following:

Sales doc typ = TFST Item cat. = TFDP NF rec.ty. = 2 Partner id = RE Tax Code = I1

ICMS Law = IC0 IPI Law = IP2 COFINS Law = CO8 PIS Law = PI8

Note that the Tax Code, ICMS Law, IPI Law, COFINS Law and PIS Law may vary from what you have in your system…

SPECIFY NOTA FISCAL CATEGORY

IMG > Sales and Distribution > Billing > Billing Documents > Country-specific Features > Brazil > Assign Nota Fiscal Type to Sales Document Types

Assign here the NFe Outgoing NF Type

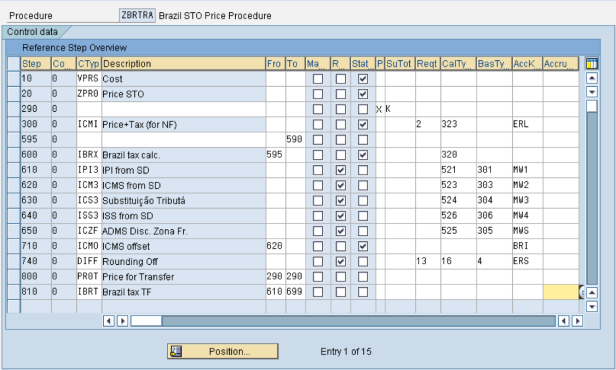

DEFINE PRICE PROCEDURE

IMG > Sales and Distribution > Basic Functions > Pricing > Pricing Control > Define and Assign Pricing Procedure

Define document pricing procedure > new entry T for Transfer

Assign document pricing procedures to order types > TFST = T

Assign document pricing procedures to billing types

Maintain pricing procedures > Create as ZBRTRA – Brazil STO Price Procedure as below:

Define Pricing Procedure Determination > Assign document T and new procedure for transfer ZBRTRA, Condition type=VPRS

ASSIGN PRICE PROCEDURE TO DELIVERY TYPE

IMG > Logistics Execution > Shipping> Basic Shipping Functions > Pricing > Define Pricing Procedures for Delivery

Assign the pricing procedure for transfer to the transfer delivery type

TAX CODE ASSIGNMENTS

IMG > Financial Accounting (New) > Financial Accounting Global Settings (New) > Tax on Sales/Purchases > Calculation > Settings for Tax Calculation in Brazil > Access Tax Manager’s Workplace

TC at GR > Tax code used in MM for GR, e.g. I1

SD TC > Billing document tax code used in SD, e.g. I1

- TC COFINS Law PIS Law

- A0 C08 P08

- A1 C08 P08

- A3 C08 P08

- I0 C08 P08

- I1 C08 P08

- I3 C08 P08

SPECIAL CONDITIONS FOR PRICING

IMG > Sales and Distribution > Billing > Billing Documents > Country-specific Features > Brazil > Special Conditions For Pricing

ASSIGN DELIVERY TYPE AND CHECKING RULE

IMG > Materials Management > Purchasing > Purchase Order > Set up Stock Transport Order > Assign Delivery Type and Checking Rule

ASSIGN DOCUMENT TYPE, ONE-STEP PROCEDURE, UNDER DELIVERY TOLERANCE

IMG > Materials Management > Purchasing > Purchase Order > Set up Stock Transport Order > Assign Document Type, One-Step Procedure, Underdelivery Tolerance

NOTA FISCAL CATEGORY DERIVATION

IMG > Financial Accounting (New) > Financial Accounting Global Settings (New) > Tax on Sales/Purchases > Calculation > Settings for Tax Calculation in Brazil > Access Tax Manager’s Workplace

Go to Menu > Nota Fiscal > Inventory Management > NF Category Derivation

Setup as follow:

OUTGOING CFOP DETERMINATION

IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Determination for Outgoing and Returns (Versioned)

INCOMING CFOP DETERMINATION

IMG > Cross-Application Components > General Application Functions > Nota fiscal > CFOP Codes > Define CFOP Determination for Incoming and Returns (Versioned)

This guide was based on SAP Note 199233 and 888805, I recommend you going over those OSS Notes along with this guide to assist you getting the Stock Transfer Order – Intracompany process working.

I hope you found this post useful.

Hi Leandropia! This is a great article! I am working thru the configuration in my system as I have a need to do the Intra-Company STO between two plants in Brazil. I am getting stuck in the taxes portion. Would you happen to have a screen shot of what the resulting posting should look like? I am trying to figure out what tax config I am missing.

Great article though!

Regards,

Rita

LikeLiked by 1 person

Rita, I do have it! I will do my best to add a screenshot and additional explanation on this subject into the same post still this week!

LikeLike

Rita, I added a sections “Accounting” to this post. I hope you find it helpful.

LikeLike

Thank you! I think I got stuck on the fact that the Nota Fiscal is generated by the delivery PGI and not an invoice. So I am now trying to figure out what I missed in my setup to make this happen.

Regards,

Rita

LikeLike

That’s correct. Your 862 movement must be relevant for NF. When you post Goods Issue (via VL02N for example), the NF will be created. You have to check SM30 J_1BIM02V-J_1BNFREL or check the section in my post “NOTA FISCAL CATEGORY DERIVATION”.

LikeLike

leandropia: That was it! the movement type 861-864 were configured in my golden client, but missing in my development client. After I retransported it, I am getting further… now I am missing a tax code/jurisdiction setup…

Thanks for your help! I really appreciate it.

Regards,

Rita

LikeLike

Glad to help! The Jurisdiction comes from either Plant Setup or Branch (Business Place Setup), check both please… it is in the address details of one of those… check Issuing and Receiving Plant/Branches.

LikeLike

Hi,

Could you please throw some light on how prices are calculated in the Nota Document(not in the sales order) ?

Regards,

Nilojjal

LikeLike

Nilojjal, in the Intracompany STO, prices are pulled from VPRS / standard price.The attachment of OSS Note 888805 will have a model pricing procedure that is recommended to be used and there is where VPRS is. There is no price calculation in the MM side (PO), but only in the SD side.

LikeLike

This is golden, I thought in order to generate invoice between STO transaction is done without SD module and it will require enhancement. I wish I read your article earlier as we have a requirement to generate account receivable entries (although I’m not in charge handle the case).

Again, thank you!

LikeLiked by 1 person

Always glad to help! Reach me if you need any help or have any questions around Brazil SAP Processes 😉 I will try my best to help.

LikeLike

Hi Leandropia. In a stock transfer scenario with ICMS and ICST (substituicao tributaria) taxes must be appropriated to stock at receiving plant, so we need to have the following accountIng:

Goods Issue at issuing Plant (1440)

Debit – Stock at Receiving Plant (5611) – e. g. 100 BRL

Credit – Stock at issuing Plant (1440) – e. g. 130 BRL ( ICMS 10 and ICST 20)

Debit – Tax Transitory (TXO) 11513410 – 30 (ICMS + ICST)

Do you have some idea what I need to do?

Thanks a lot for attention,

Sergio

LikeLike

Hi Leandro. First of all congrats for the articles you’ve posted about STO process, they really help a lot!

I’m trying to implement STO process but I’m facing problems concerning the IPI accounting. Only ICMS is correct and b in the brings the accounting documents. Do you have any idea where can I start attacking the problem? Do you believe is something related to the value strings WA04 and TXBR?

Really appreciate any information that might help me!

Thank you in advance!

LikeLike

I can run the program Z_CREATE_STF_MOVEMENT_TYPE that is quoted in Note 323649 – BR / TF: Creation movement types for Stock Transfer to ECC version 6.0, Support Package 28?

We use TAXBRA and not TAXBRJ.

Thanks

LikeLike

Sure you can… then you will have to recreate the taxes strings changing to TAXBRA on J_1BIM01

LikeLike

I will do that now.

Thanks,

LikeLike

Thank you so much !

LikeLiked by 1 person

Thank you, very helpful

LikeLike