BLOCK K (Bloco K)

You may not know but your company might be running against time to get ready to report the SPED Block K.

The Brazil corresponding to IRS (RFB – Receita Federal do Brasil) and CONFAZ recently added “Block K – Production and Inventory Control” to the SPED EFD Fiscal (which is monthly reported to each existing branch in your company in Brasil).

The Block K is mandatory to report starting in January 2016 for all industries in Brasil, except the “Simples Nacional” and MEI.

Block K provides information related to inputs/raw material and products it has in stock, as well as submit all information related to the production of its products. This information should be presented both for inputs and finished goods in company’s inventory and in third-party stock.

The law that introduced the Block K is the “Convenio 143/06” and the contributor Guide with the SPED Block K layout can be found here: Guia Prático EFD Versao 2.0.16

What worries accountants and companies’ owners the most is the difficulty in starting controlling the production in its smallest details, in other words, unveil the Costing Accounting, which, most of them have never dealt with.

Old Scenario

In the old scenario, the companies were reporting separated reports to:

- Incoming Legal Books (Modelo 1)

- Outgoing Legal Books (Modelo 2)

- Stock and Production Control (Modelo 3)

- Inventory Records (Modelo 7)

- IPI Tax Collection (Modelo 8)

- ICMS Tax Collection (Modelo 9)

- Import and Export Controls

- Tax Credit controls

Scenario with Block K

With the addition of block K to SPED Reports, the Stock and Production control will be added to the digital reports which also cover the stock movements, production and goods consumption; it improves the tax reporting management, avoids tax evasion and provides efficiency in the control and results in the company and to the government.

With this new requirement, there is no doubt that those who work with professionalism and meet the legislation will to protect from unfair competition from those that follow the path of informality.

Impacted Areas:

- Accounting

- Billing and Invoicing

- Costing

- Direct and Indirect Material

- Fiscal and Tax

- Inventory and Warehouse Management

- IT

- Master Data

- 3rd Partners Manufacturing

- Own Manufacturing

- 3rd Partners Stock

- Own Stock

- Plan Maintenance

- Procurement

- Production Orders

- Quality Management

- Sales

- Scheduling and Planning

- Transportation

- Vendor Master Data

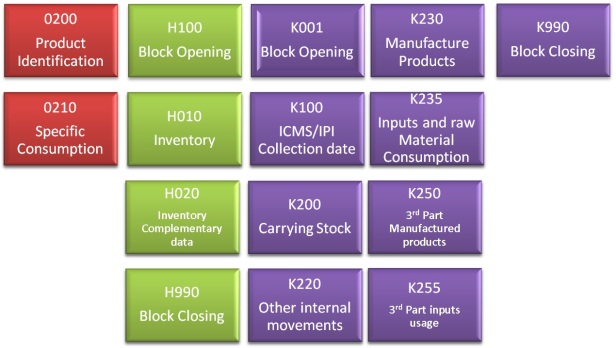

Registers

0210 – Consumo Especifico Padronizado (Standard Consumption Specific)

With this register, the industry (or equivalent) taxpayers should inform the Standard Consumption Specific and the regular percentage loss of an input/raw material/Component to manufacture another product.

The data has to be informed according to the production technique of its manufacturing activity to the product that was manufactured by the company or 3rd partners. The wholesalers are not required to present this register.

The data can only be presented to the products in process or finished goods.

The SPED layout for this register allows only one BOM (0210) to each product (0200) and the current BOM existing in the 1st day of the month is the one that is taken in consideration.

K100 – Periodo de Apuração do ICMS/IPI (ICMS/IPI Appraisal Period)

This register informs the ICMS and IPI tax collection period. Taxpayers with more than one tax collection period in the same month will need to report one K100 to each existing period and the subsequent registers will be reported according to the K100 periods.

K200 – Estoque Escriturado (Stock Bookkeeping)

The purpose of this record is to inform the final inventory carrying in the informed period and items will be sorted as:

- 00 – Goods for resale

- 01 – Raw Materials

- 02 – Packaging

- 03 – Process Products

- 04 – Finished Product

- 05 – Sub-product

- 10 – Other inputs

The Unit of measure must be the same as informed in register 0200.

K220 – Outras Movimentações Internas entre Mercadorias (Others Internal Movements among Goods)

This register is used to report other products moves that are not listed in K230 and K235, for example products re-assigned to another material number.

K230 – Itens Produzidos (Produced Items)

In this register, it will be reported the manufacturing of Process Products and Finished Goods (respectively Types 03 and 04 in register 0200 Item Type field).

The register shall be reported by product, even if the amount of finished product is zero, in situations where there is consumption of component item / input in the child record K235.

K235 – Insumos Consumidos (Consumed Items)

This register has to be used to inform the consumption of goods in the production process required to the product that will be informed in the “Código do Item” of Register K230.

The amount of consumed inputs should be adhering to the data reported in register 0210 – Specific Consumption Standardized, except in the case of information of replaced materials.

K250 – Industrialização Efetuada por Terceiros / Itens Produzidos (Industrialization done by 3rd Party (produced items))

In this register it is informed the products that were manufactured by the company or 3rd partners.

K255 – Industrialização Efetuada por Terceiros / Consumed Inputs (Industrialization done by 3rd Party (consumed items))

This register will inform the quantity of raw material consumption that it was sent to be industrialized by 3rd partners, linked to the resulting product set in the “Código do Item” on register K250.

Where to Start?

First you need to do an assessment and planning the details to adequate your business processes that are part of the Production and Manufacturing to what the Tax Authorities are expecting.

If you are an IT person, check with your tax department what are the whole Block K requirements and map every single detail of the industrialization process, 3rd partner industrialization, inventorying. Check on SAP what are the registers that are standard delivered and the ones that require enhancements via BAdI.

If you are a business person, check with your IT department (or IT partner) how to get ready to the new requirement.

Get all the impacted areas listed above involved and training them in the processes changes and tests.

Did I say test? Yes, do massive tests, and if you don’t have a good QAS environment, you may want consider a refresh asap.

OSS Notes

The OSS Notes below is the SAP starting point to implement the new layout:

1977068 – LC Announcement SPED ICMS/IPI: Ato Cotepe 52/2013

1991058 – SPED EFD: Block K – Source code implementation (layout 9)

My friend Fabio Antunes just reminded me that the OSS Note below contains the layout 10, which is required for January 1st, 2016:

2206023 – SPED EFD: Block K – New Layout Version 10 & K235 Reversal Posting

Search on SAP Notes for all Oss notes that contains “Block K” in the description and are relevant to your release (see my other post on how to search OSS Notes using the classic way)

What happens if your company misses submitting the Block K or submits it with errors?

The company can be prosecuted, get a fine or to have the IRS (Receita Federal do Brasil) services suspended, such as issuing Nota Fiscal.

Business concerns

The Block K, different than other registers and blocks requires some level of process control in many different areas impacted with this registers and also the fact that now the reports to tax authorities will contain data that could be considered as an industrial secret, especially because you will have to report the bill of material of your manufactured products.

In this report, the company will have to inform the volume of products manufactured in a given period of dates, also the inputs and raw material usage over the different manufacturing and production steps. It is also required reporting the movements with 3rd partners involved in the manufacturing process.

So far, the Block K information only requires reporting quantities, but it may happen that in a near future it will also be required to report amounts (such as inputs amounts, operational costs, inventory amounts and etc.).

With all those requirements, the tax authorities can analyze the movement of production and stocks in confronting with raw materials and inputs used in the process, BOM and finished products. With this information on hands the tax authorities brought an endorsement to demand the BOM the fact that the right to request information that is considered important in their inspection process. That means, to them the information should be available and they will not be (or should not) share it with third parties.

Therefore, we can’t deny that the major difficulty of a company to adapt to this requirement relates not only to the proper fulfillment of all the required information for each register in the block that will be mandatory, but also on the way how company manages and controls its entire production process, both with respect to their products master records as with regard to the nuances of the controls, generation, systemic parameterization and inventory management in 3rd partners possession. Therefore adequately meet this new requirement does not depend on only one sector of the company, but the joint efforts of various departments, both administrative and operational area.

That’s it and I hope you are on track to meet the deadline.

Hi Leandro,

Nice inputs about the Block K.

Also I would like to share with you that SAP already delivered the OSS note 2206023 – New Layout Version 10 & K235 Reversal Posting.

This implementation is required because affects the new upcoming PVA (Application used to validate and transfer the files to legal entities) versions.

Keep in touch buddy!

Fábio Antunes

SAP FICO Consultant & Tax Specialist

LikeLiked by 1 person

Thanks Man! I am updating this information on this post.

LikeLike