There are many reasons why you will need to create a tax dynamic exception. Just to mention an example, the ICMS is based on the combination of Ship From and Ship To region, and the table J_1BTXIC1 is maintained with this combination.

However, not always it is like that. There are certain situations where the ICMS Rate or the ICMS Base for example, needs to be overwritten, for a specific customer, or product or even for one Specific Customer and Product only, while other products sold to the same customer they follow the regular rate and/or base…

One other example, and this came with the changes proposed by the Adjust SINIEF 19 and 20 and also the 13th Senate Resolution, it is, when imported goods are sold to outside of the origin state, the ICMS is 4% (and not the regular interstate rate).

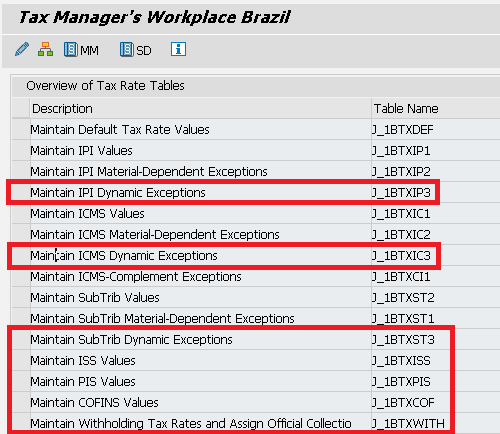

By reaching the transaction J1BTAX*, you will be able to maintain taxes dynamic exceptions.

I am not going through one by one of those entries, but I did highlighted the entries that will accept tax dynamic exceptions by using the tax groups that you created as per my last post instructions.

* You can also reach the entries above by using the individual transactions below:

Maintain Default Tax Rates Values S_ALR_87003324

Maintain IPI Values S_ALR_87003326

Maintain IPI Material exception S_ALR_87003329

Maintain IPI Dynamic exception S_ALR_87100870

Maintain ICMS Values S_ALR_87003332

Maintain ICMS Material dependent exception S_ALR_87003334

Maintain ICMS Dynamic exception S_ALR_87100868

Maintain ICMS Complement exception S_ALR_87003230

Maintain Subtrib values S_ALR_87003232

Maintain Subtrib Material dependent exception S_ALR_87003236

Maintain Subtrib Dynamic exception S_PL0_09000292

Maintain ISS Values S_P6D_40000012

Maintain PIS Values S_P6D_40000013

Maintain COFINS Values S_P6D_40000014

Maintain Withholding Tax Rates and Assign Official Collection Codes S_P6D_40000030

Let’s see an example:

If we go to the entry “Maintain ICMS Values” and pick for example the combination of Ship from: SP and Ship to: RS you will see that the regular interstate rate between those two regions is 12%

So, when entering a Sales Order to a customer in RS where the shipping plant is in SP, the ICMS will be 12% based on the rule above:

However, based on a law changes in place since 2013, the ICMS Rate for imported products sold to outside of the origin state is 4%.

SAP will always read the tax rates in the following sequence:

1 – Dynamic Exceptions Tables (Such as J_1BTXIP3, J_1BTXIC3, J_1BTXPIS, J_1BTXCOF and etc.)

a) Starting from lowest group to highest

2 – Material Dependent Tables (Like J_1BTXIP2, J_1BTXIC2 and etc.)

3 – Standard Tax Tables (Example: J_1BTXIP1, J_1BTXIC1 and etc.)

4 – Default Tax Rates (J_1BTXDEF table)

So, I can’t just go to J_1BTXIC1 and change the Combination of SP to RS from 12% to 4% because, the standard rate is 12% and ONLY when goods are imported, the ICMS will be 4%… So, I would be able to build the “exception” using the J_1BTXIC2, but, this would require MANY entries (depending on the number of imported material and the states that you sell, thousands of entries).

Since the Material Origin is in the Material Master Records (MBEW-MTORG) you can use a group for ICMS based on Material Origin.

Check on previous post, this is represented to me as group 80:

So, I entered the following entry:

After saving the entry above, I did update the pricing on my order and the result is:

You can also change the calculation base, instead of using 100%, you may need to calculate certain tax over a reduced base.

Sometimes, users may complain and say that an order is calculating the incorrect tax rate or base for an specific order, and the easiest way to identify where the rate/base is coming from, is hitting the button “Analysis” at conditions view:

Navigate to the Tax Rate Condition that user mentioned it is incorrect, in this example, the ICMS, tax condition ICVA.

You will see that an exception was found on group 80 to calculate 4% based on the combination of Ship From SP, Ship To RS and Material Origin 1. As the law says that in this case the tax rate is 4%, you may discuss with the user, because if he insist that the rate supposed to be 12%, that means the product is not imported, and in this case, the Material Origin at Material Master Records should not be 1, but Zero instead.

The examples above, the usage of Tax Rate Tables are valid for MM and SD (Purchase Orders and Sales Orders). The Standard Tables and the Material Dependent Tables are valid for both MM and SD at the same time, while the Dynamic Exceptions can be valid for SD only, MM only or both (as explained on my previous Post).

The combination of tax groups can lead you to infinite possibilities of calculating the correct tax rate for your business, and usually, the tax department (business) is responsible for maintaining those entries.

I do not recommend give access to the J1BTAX transaction as it contains entries to other technical data. So, you can give access to the individual transactions. Check more information about this in my next posting…

Copyright Notice: © Leandro da Pia Nascimento and SAPBR.COM (SAP BRAZIL) WordPress Blog, 2013 to 2015. Unauthorized use and/or duplication of this material without express and written permission from this blog’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Leandro da Pia Nascimento and SAPBR.COM with appropriate and specific direction to the original content.

God job buddy! Very useful information!!!

LikeLike

Thanks! Please, Share! Click in Share Link buttons “Facebook” or “LinkedIn” and share between your contacts…

LikeLike

Hi Leandropia! These documents have been very useful to me. I have a question though. I have a situation when I am purchasing imported finished goods with a material usage of Resale that are being bought for industrialization. The problem I am having is the base amount for PIS/COFINS is including the IPI amount in the base and this is not correct according to our tax person in Brazil.

If I change the material usage from resale (0) to industrialization (1) , the taxes are calculated correctly on the PO (my tax code is IC).

I am trying to figure out what configuration setting in SAP is controlling whether to include/exclude IPI in the base amount for PIS/COFINS. My materials have to be coded with material usage resale (0).

OR is this done in the code per OSS note 947218 – IPI value included in PIS/COFINS base for resale for consumption and I need to create the missing tax conditions per OSS note 1063650 – Base amount for PIS/COFINS by resale for IPI Contributor for industrialization?

I feel like I am missing seeing a basic piece of the configuration that ties everything together and I am hoping you can point me in the right direction.

Regards,

Rita

LikeLike

Hi Rita, glad to hear that this blog has been helpful to you. You’re right, the results you need will come from those 2 OSS Notes, and this is a painful subject 😦 … I didn’t like the solution provided to this topic, but I dislike more the law requirements around this subject… sometimes it is hard to complain about the Solution delivered by SAP when the law itself is so complex. Why you can’t use the Material Usage 1 – Industrialization and needs to be 0 – resale? I am curious…

LikeLike

Hi Leo – thanks for the quick response. You really should write a book on how to implement Brazil taxes using SAP…

Our tax manager in Brazil gave me this answer: Finished goods being brought should be 0 – Resale and this does not add IPI to the base for Cofins/Pis.

we are importing polymer that is sold to customers to manufacture with.

Thanks again for your help. I will try to implement the new conditions per OSS note 1063650 and see if I can get it to work that way.

Best Regards,

Rita

LikeLiked by 1 person

That’s a good idea! But tax requirements changes in Brasil are so dynamic and frequent that by the time I end the book, I would need to re-write all over again… lol

Polymers… hum… I work to a chemical industry too and polymers are one of our products…

So, if the polymers you buy, you are not using in local manufacturing, then it is correct to be 0 – resale;

If you import polymers and you do manufacturing before selling it, then in that case it should be 1.

Anyway, you will have to review the OSS Notes you mentioned. I may have one information or other regard this subject, I have implemented it in 2 different gas & oil companies few years ago and I am pretty sure I have my notes somewhere in my computer.

Reach-me if you need any help and I will try my best to help.

Good Luck!

LikeLike

Hi Leo. I am working through OSS 947218 and I am at the step that maps the condition to the Nota Fiscal and I am a little confused. The note says “Conditions BX73 and BX83 must be used in the Nota Fiscal Mapping for the source of the tax value of the active PIS/COFINS condition transferred to the Nota Fiscal”. But it doesn’t give any details, so I am not exactly sure what I am supposed to do here. Do you know? You can email me directly if that is better – Rita.timmons@kraton.com

Thanks for your help!

Regards,

Rita

LikeLike