The first NFe (Electronic Nota Fiscal) was issued in Brasil in September, 2006 and that became mandatory for most of the companies in 2009/2010.

While official Layout changed from 1.00 to 2.00 and then to 3.10 (actual) along of those years, SAP delivered and has been enhancing over the years the NFe Solution to follow those changes and meet the legal requirements.

Many people that I know still reject to engage in a NFe Project because they are afraid to fail for not having the opportunity to do it before.

The idea of this (and the next postings) it is to show you that implementing the NFe changes can be simple if you think simple.

Before coming to this blog, there are several other sources of information that you can go first.

I would recommend checking them first:

SCN NF-e & SPED Community – Content is in portuguese but you can always use google translator or use that as an excuse to learn Portuguese (I’m kidding, don’t waste your time learning portuguese)

NFE Boas discussões – Leia antes de postar – Here a list of several different topics, a little bit out of date but still good to review

SAP Nota Fiscal Eletrônica – Directly from SAP Help

Before you start configuring, I also recommend to review the OSS Notes below:

2056762 – Guidelines for NF-e layout 3.10 SAP Notes installation

2057942 – Guideline for NF-e layout 3.10 implementation in ERP and SAP NFE

2060171 – [3.10] Announcement Note – NF-e Layout 3.10

2123768 – KBA [3.10] NF-e 3.10 go-live checklist for SAP NF-e GRC

2125859 – KBA [3.10] NF-e 3.10 go-live checklist for SAP ERP

And don’t forget to implement the latest SLL-NFE Support Package (currently SP21)

2170295 – SAPK-90021INSLLNFE: Support Package 21 for SLL-NFE

I am not going to discuss a scenario in specific. You will see here only the general concept, but keep in mind that before start configuring, you should work on an assessment, map the scenarios, the different processes and requirements for issuing NFe in your company/customer.

So, let’s see how to configure the NFe system (Aka GRC NFe). Most (but not all of them) of the Configuration in SPRO are organized as following:

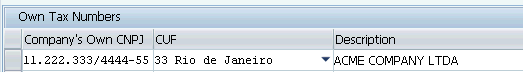

1) Maintain Own Tax Numbers

It couldn’t be simpler than that: Here you enter your company’s CNPJ (one entry per business place), Type a description (Business Place Name for instance), and the UF region in which the CNPJ is registered.

Table: /XNFE/V_TCNPJ

SPRO > Nota Fiscal Eletronica > General Settings > Maintain Own Tax Numbers

2) Digital Signature Configuration

This is usually maintained by Basis, so, if you are not comfortable handling it or you don’t have the proper authorization, don’t get shy asking someone on Basis’s team to do that for you…

3) Maintain System Security Information

For every Secure Store and Forward (SSF) application, you must import the certificates that you have purchased from the authorities. This is done in the Trust Manager. Here define and monitor the personal security environments (PSEs) in the SAP system, which are used for digital signatures and encryption in SAP systems.

SPRO > Nota Fiscal > General Settings > Signature > Maintain System Security Information

4) Maintain Application-Dependent SSF Information

You receive an overview of existing SSF applications and you must create entries for each of your own tax numbers. Here you specify the application-independent parameters for using the SSF (secure store and forward) functions.

The applications that use the SSF functions do not all have to use the same security environment.

SPRO > Nota Fiscal > General Settings > Signature >Maintain Application-Dependent SSF Information

5) Name the Logical Destination

Here is one more activity that it is usually maintained by someone on Basis team, the RFC connection. Starting from naming the logical destinations, create the Logical Destination entries to be used in the RFC connection in this customizing.

SPRO > Nota Fiscal > Communication to ERP Back End System > Name the Logical Destination

Define the logical systems to which you want to connect your SAP Nota Fiscal Eletronica (SAP NFE) system. A logical system needs to be defined for each back-end (ERP) system to enable your SAP Nota Fiscal Eletronica system to establish a connection with the ERP system.

6) Create RFC Connection

The parameters of an RFC destination are used to control the Remote Function Call (RFC). That’s how the NFe, ECC and PI clients will exchange communication between them.

You need an RFC destination for each logical system that you want to connect with your SAP Nota Fiscal Eletronica system.

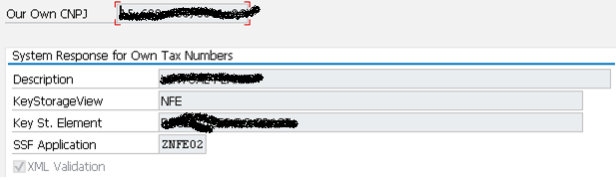

7) Maintain System Response for Own Tax Numbers

You use the tax number of your company to define the storage location of the digital certificate that you will use for digital signatures, and whether or not you use the productive or homologation system environment, the digital certificate is required.

SPRO > NOTA FISCAL > OUTBOUND > MAINTAIN SYSTEM RESPONSE FOR OWN TAX NUMBERS

For each CNPJ, maintain the Business Place description, KeyStorageView, Key Storage Element and SSF Application (ask Basis if you don’t know).

8) Define Authority’s Tax Code

Here it is defined the codes and their descriptions that the authorities can use as answers to an electronic message in communication for handling notas fiscais. Based on this list, you can see in the application how official code affects the status of the NF-e. The assignment of a code to a clear description makes it easier for you to initiate follow-on activities and fix issues.

SPRO > Nota Fiscal > Outbound > NFe > NF-e: Define Authority’s Status Code

Table /XNFE/TSTAT

You can find an updated list here in this link:

Tabela atualizada das mensagens de retorno/erro da SEFAZ

Continue…

Nicely explained, thanks for posting

LikeLiked by 1 person